Get Pain Free Body, Move and Feel Better With the Best Ergonomic and Office Chairs From Latestchairs.com.

Are You Suffering From Any of These

We have SOLUTIONS for you…

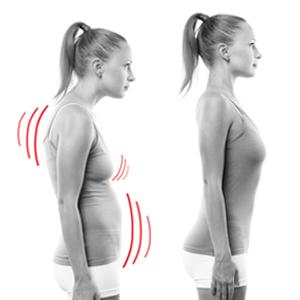

If you suffer from back pain, Neck Or Shoulder Pain, Knee Pain, Headaches, and spent thousands of dollars on different treatments, therapies, and equipment, you are not alone.

At Latestchairs.com we review and recommend an extensive range of high-quality and user-friendly ergonomic products and solutions with many functional features and health benefits that aim to improve body posture, reduce stress, tension, and pain in the body.

Latest Articles

- Do Rolling Office Chairs Damage Wood Floors?

Hardwood floors can give an elegant look and complement your office design. You can move your office chair easily on these hardwood floors, which is…

Hardwood floors can give an elegant look and complement your office design. You can move your office chair easily on these hardwood floors, which is… - 4 Reasons Why You Should Not Buy A Glass Mat For Hard Floors

Hardwood floors can create a cohesive look on your office floor. But continuous rolling of office chairs on the hardwood floors can cause scratches, scuff…

Hardwood floors can create a cohesive look on your office floor. But continuous rolling of office chairs on the hardwood floors can cause scratches, scuff… - 12 Characteristics of Luxury Kitchen Cabinets

A luxury kitchen cabinet goes beyond basic storage and serves as a statement piece in a high-end kitchen, combining aesthetics, functionality, and premium materials. Characteristics…

A luxury kitchen cabinet goes beyond basic storage and serves as a statement piece in a high-end kitchen, combining aesthetics, functionality, and premium materials. Characteristics… - Otto Zapf: The Famous German Artist and Furniture Designer

Otto Zapf was born on 10 August 1931 in Rossbach, Czechoslovakia. He was born into a lineage of carpenters and cabinet makers. His family experienced…

Otto Zapf was born on 10 August 1931 in Rossbach, Czechoslovakia. He was born into a lineage of carpenters and cabinet makers. His family experienced… - What Are Hurricane Shutters?

Hurricane shutters are not a subject of mere curiosity for those living in storm-prone areas; they are a vital part of home protection. These unique…

Hurricane shutters are not a subject of mere curiosity for those living in storm-prone areas; they are a vital part of home protection. These unique… - How to Maintain a Leaf Blower at Home

Maintaining a leaf blower is crucial to ensure its optimal performance and longevity. Regular maintenance not only extends the lifespan of your leaf blower but…

Maintaining a leaf blower is crucial to ensure its optimal performance and longevity. Regular maintenance not only extends the lifespan of your leaf blower but…

About Us

Latest Chairs is a site that is focused on seating and chairs. It gives information about all kinds of Floor Chairs, Massage Chairs, Executive Chairs, bean Bags, ergonomic chairs, etc. The site offers the latest news in this industry by giving updates from time to time as well as providing details about new products launched in the market.